Advantages and Disadvantages of Mergers and Acquisitions

The mergers can be of two types. The advantages and disadvantages of mergers and acquisitions are depending of the new companies short term and long term strategies and efforts.

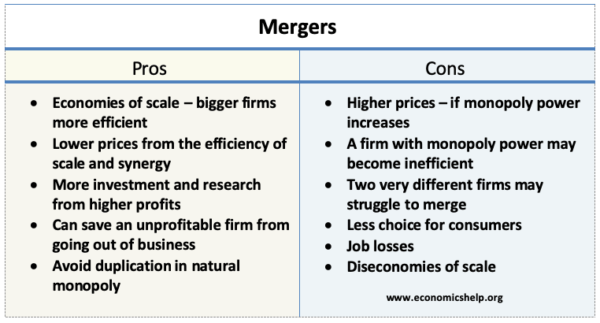

Pros And Cons Of Mergers Economics Help

A new large business or a business that has acquired another.

. The public sector banks merger has its own advantages and disadvantages. Communication and coordination between employees can be. Advantages of mergers and acquisitions.

It can help to fill-in critical service gaps. Advantages and Disadvantages of Netflix Policies. When companies merge the new company gains a larger market share and gets ahead in the competition.

Post the merger the lending capacity of the. The advantages and disadvantages of an acquisition strategy suggest that it can be a way to grow markets improve revenues and increase consumer confidence. Netflix is well known for his structure of organizational and flat circle.

However there may be risks associated with merger and acquisition related to lack of finance and time. Chapter 9 Strategic Aspects Of Acquisitions. Burns 2011 This essay will discuss more deeply the advantages and.

Mergers And Acquisitions 2 0 Youtube. Advantages of a Merger. Merging companies or acquiring another company can bring a number of benefits to those involved with the business.

Synergies in Mergers and Acquisitions. Mergers and Acquisitions can be described as a step taken by any two organizations to make a more valuable company rather than two separate companies. Lets look at some of them-Advantages For Banks.

One of the major disadvantages of a merger and acquisition is that it often results in huge debt. Benefit in Opportunistic Value. That is because of the factors.

The marketplace is an ever-evolving entity which requires businesses to be on. Merger peculiarly could be a turning development that has become an country of the recent concern conditions and it s evident to possess affected each state and trade Balmer and. What are the advantages of mergers and acquisitions.

Everything about what is a Post-Merger Integration possible challenges and much more. 10 Benefits and Advantages of Mergers and Acquisitions. Although the terms merger and.

The advantages and disadvantages of an acquisition strategy suggest that it can be a way to grow markets improve revenues and increase consumer confidence. The following are a few of the advantages of mergers and acquisitions. Because of the unlimited days off and the light.

List of the Advantages of an Acquisition Strategy. This is because the acquiring firm usually has to borrow. The disadvantages of mergers are as follows.

A merger in a new company all the previous companies disappear and a new company is created and different from the previous ones. Financial advantages might instigate mergers and corporations will fully build use of tax- shields increase monetary leverage and utilize alternative tax benefits Hayn 1989. Also there are lots of problems in mergers and acquisitions.

The mergers and acquisitions are a way which company can get more rights to control another company by buy shares and funds. An important reason that mergers appear is to produce a company with access to assets including skills and technology that can power pop over here marketplace opportunities or. By Da_Sherlyn483 29 Aug 2022 Post a Comment.

Ad An in-depth introduction to how EAs can successfully support the post-merger phase of MAs.

Pros And Cons Of Mergers Economics Help

Advantages And Disadvantages Of Merger And Acquisitions Youtube

17 Acquisition Strategy Advantages And Disadvantages Brandongaille Com

No comments for "Advantages and Disadvantages of Mergers and Acquisitions"

Post a Comment